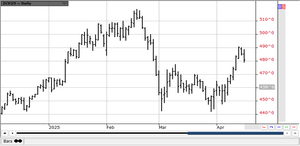

Teucrium Soybean Fund ETV (SOYB)

21.87

+0.14 (0.63%)

NYSE · Last Trade: Oct 2nd, 4:14 PM EDT

Detailed Quote

| Previous Close | 21.73 |

|---|---|

| Open | 21.69 |

| Day's Range | 21.69 - 21.96 |

| 52 Week Range | 20.20 - 23.25 |

| Volume | 112,914 |

| Market Cap | 262.39K |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 71,136 |

Chart

News & Press Releases

September 2025 concluded with a stark divergence in the global commodity markets, painting a clear picture of winners and losers driven by a confluence of macroeconomic shifts, geopolitical uncertainties, and fundamental supply-demand dynamics. While precious metals staged an impressive rally, reaching multi-year and even all-time highs, the agricultural sector, particularly

Via MarketMinute · October 1, 2025

In a significant blow to U.S. soybean farmers, China, their largest buyer, has ceased purchasing their crops, leaving them with a surplus, choosing instead to source from Brazil.

Via Benzinga · September 12, 2025

U.S. soybean farmers have urged President Donald Trump to secure a trade deal with China that includes substantial soybean purchases, warning of severe long-term economic consequences if the U.S. crop continues to be shunned.

Via Benzinga · August 20, 2025

Rice closed a little lower again on follow through selling.

Via Talk Markets · April 25, 2025

Cotton was higher as demand ideas got help when Mr. Trump dialed back on his tariff threats and threats on the independence of the Fed.

Via Talk Markets · April 24, 2025

Gold prices surged to fresh highs amid concerns about the US Federal Reserve’s independence. Oil and other risk assets, however, are under pressure amid heightened global uncertainty.

Via Talk Markets · April 22, 2025

Rice closed lower but futures are still holding to a sideways trend.

Via Talk Markets · April 21, 2025

A creeping rotation out of U.S. assets and a subtle, but steady, rethink of the dollar as the default global parking spot.

Via Talk Markets · April 18, 2025

Remarkably, May Beans have managed to rally 90 cents (970-1050) this month despite the massive tariffs against China – as other countries have stepped up their exports.

Via Talk Markets · April 16, 2025

Rice closed higher again and are holding to a sideways to up trend.

Via Talk Markets · April 15, 2025

Oil prices rose yesterday despite OPEC making some small downward revisions to demand growth estimates.

Via Talk Markets · April 14, 2025

Rice closed higher again as the U.S. will negotiate on tariffs with all countries except China.

Via Talk Markets · April 10, 2025

Trump surprised markets with a 90-day pause in reciprocal tariffs for most trading partners. This provided a boost to risk assets, including commodities. However, there’s still plenty of uncertainty as the US again increased tariffs on China.

Via Talk Markets · April 10, 2025

Cotton was lower in a further response to the Trump tariffs that threaten to greatly increase the costs of imports from China and Vietnam among other things.

Via Talk Markets · April 9, 2025

Rice closed mixed yesterday, with the trade reacting to less than expected stocks but higher than expected intended area planted from USDA.

Via Talk Markets · April 2, 2025

Oil prices rose yesterday as the US threatened secondary tariffs on Russian and Iranian oil.

Via Talk Markets · April 1, 2025

Soybeans and the products closed higher, with Soybean Oil the strongest part of the complex.

Via Talk Markets · March 28, 2025

Rice closed lower, with trading slow before the USDA stocks in all positions report and the prospective plantings report coming on Monday.

Via Talk Markets · March 26, 2025

CBOT corn corrected as newly published average U.S. acreage guesses push above USDA’s Outlook Forum estimate of 94 Mil, while Brazilian futures extract premium on improving rain chances.

Via Talk Markets · March 26, 2025

Soybeans and the products closed higher and Soybean Meal was the weakest link as basis levels remained firm in Brazil.

Via Talk Markets · March 24, 2025

Palm Oil futures were lower on what appeared to be speculative long liquidation before the weekend.

Via Talk Markets · March 21, 2025

Rice closed a little higher after a slow and choppy session.

Via Talk Markets · March 19, 2025

Tensions in the Middle East have resurfaced, supporting oil prices. The market is also watching closely the outcome of talks between Donald Trump and Vladimir Putin.

Via Talk Markets · March 18, 2025

A weaker US dollar provided some support to the commodities complex yesterday. However, markets remain sensitive to external developments.

Via Talk Markets · March 12, 2025