MP Materials Corp. Common Stock (MP)

58.03

+0.00 (0.00%)

NYSE · Last Trade: Feb 17th, 6:38 AM EST

MP Materials and USA Rare Earth are solving the same problem. Which one will make investors rich over the long term?

Via The Motley Fool · February 14, 2026

President Trump's Project Vault has rare earth stocks surging. Here are 7 critical questions about which mining stocks could benefit from the $12B initiative.

Via InvestorPlace · February 13, 2026

The domestic critical minerals market has been set ablaze this February as shares of USA Rare Earth (NASDAQ: USAR) experienced a historic rally, surging more than 60% year-to-date. This explosive movement stems from a powerful confluence of massive federal intervention and high-level financial speculation. At the heart of the frenzy

Via MarketMinute · February 13, 2026

The U.S. government continues to support the domestic rare-earth industry, and that's good news for MP Materials.

Via The Motley Fool · February 13, 2026

NATO's action across the pond has investors uneasy about this rare earth stock today.

Via The Motley Fool · February 12, 2026

Securing a domestic supply of critical rare-earth materials and magnets is a priority for the current administration, which means USA Rare Earth is in favor.

Via The Motley Fool · February 12, 2026

As of February 11, 2026, the global economy is navigating the aftershocks of a geopolitical standoff that nearly dismantled the post-war trade order. The "Greenland Tariff Escalation," a high-stakes diplomatic confrontation sparked by the United States’ aggressive pursuit of the world’s largest island, has shifted from an imminent trade

Via MarketMinute · February 11, 2026

MP Materials surged 224% in 2025. Can the rare-earth miner beat the market in 2026?

Via The Motley Fool · February 11, 2026

Is this deal as good as it seems for USA Rare Earth?

Via The Motley Fool · February 10, 2026

Via MarketBeat · February 9, 2026

These mining stocks could help you hit pay dirt.

Via The Motley Fool · February 9, 2026

The periodic table never looked so lucrative. These three mining stocks want to capture the upside.

Via The Motley Fool · February 7, 2026

The geopolitical landscape was rocked in early 2026 by the so-called "Greenland Episode," a diplomatic and economic confrontation that has pushed the relationship between the United States and the European Union to its lowest point in decades. What began as a renewed U.S. strategic interest in the Arctic territory

Via MarketMinute · February 6, 2026

The rare earth stock could vault higher in 2026 if it meets this crucial target.

Via The Motley Fool · February 6, 2026

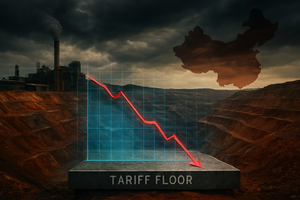

In a move that has sent shockwaves through global commodities markets, rare earth and critical materials stocks suffered a sharp sell-off this week following the U.S. administration's announcement of a "tariff floor" policy. The new regulatory framework, unveiled by Vice President J.D. Vance during a Critical Minerals Ministerial

Via MarketMinute · February 5, 2026

According to a Financial Times report, the proposal aims to secure the institution’s financing authority for another decade while boosting its capacity to back strategic industries.

Via Stocktwits · February 4, 2026

Manufacturing Wakes Up, Stocks Party Onchartmill.com

Via Chartmill · February 3, 2026

The announcement, delivered from the East Room alongside the CEOs of the nation's largest industrial titans, marks a fundamental shift in U.S. economic policy. By treating critical minerals with the same strategic gravity as crude oil, the administration intends to provide a "sovereign shock absorber" for domestic manufacturers. For

Via MarketMinute · February 2, 2026

In a move set to redefine the physical limits of artificial intelligence hardware, the United States and Japan have formalized a series of landmark agreements aimed at fortifying the semiconductor supply chain. At the heart of this alliance is a proposed $500 million synthetic diamond production facility in the U.S. and a comprehensive rare earth [...]

Via TokenRing AI · February 2, 2026

MP Materials Corp (NYSE:MP) shares are moving higher on Monday after reports that President Donald Trump aims to reduce China's dominance in rare earth materials through a $12 billion strategic stockpile of critical minerals.

Via Benzinga · February 2, 2026

Via MarketBeat · February 2, 2026

The global financial markets are still reeling after a tumultuous January that saw the return of "Twitter-diplomacy" and high-stakes protectionism. Following President Donald Trump’s aggressive mid-month demand for the United States to purchase Greenland, a move punctuated by threats of sweeping tariffs against European allies, the Dow Jones Industrial

Via MarketMinute · February 2, 2026

MP Materials has surged almost 200% since last year. Can it beat the market in 2026?

Via The Motley Fool · January 31, 2026

The final week of January 2026 has been defined by a return to "tariff diplomacy" and a surreal geopolitical standoff over the world’s largest island, sending ripples of volatility through the S&P 500. President Trump’s dual-track strategy of threatening 100% tariffs on Canadian goods while simultaneously pressuring

Via MarketMinute · January 30, 2026

The global financial landscape has been jolted by a profound "Greenland rift" as the United States aggressively asserts its territorial ambitions over the autonomous Danish territory. This geopolitical friction, which reached a fever pitch in January 2026, has pitted Washington against Copenhagen and Brussels, triggering an unprecedented deployment of European

Via MarketMinute · January 30, 2026