Eli Lilly (LLY)

1,052.08

-6.11 (-0.58%)

NYSE · Last Trade: Feb 9th, 1:20 PM EST

Detailed Quote

| Previous Close | 1,058.18 |

|---|---|

| Open | 1,077.09 |

| Bid | 1,052.03 |

| Ask | 1,052.93 |

| Day's Range | 1,048.16 - 1,106.94 |

| 52 Week Range | 623.78 - 1,133.95 |

| Volume | 1,699,983 |

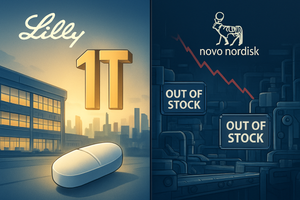

| Market Cap | 1.01T |

| PE Ratio (TTM) | 51.47 |

| EPS (TTM) | 20.4 |

| Dividend & Yield | 6.000 (0.57%) |

| 1 Month Average Volume | 3,498,848 |

Chart

About Eli Lilly (LLY)

Eli Lilly is a global pharmaceutical company dedicated to discovering, developing, manufacturing, and marketing innovative medicines that address some of the world's most challenging health issues. The company focuses on areas such as diabetes, oncology, immunology, and neurodegenerative diseases, providing a wide range of treatments designed to improve patient outcomes and quality of life. Eli Lilly is committed to scientific advancement and works collaboratively with healthcare professionals and researchers to bring new therapies and solutions to market, ensuring access to life-saving medications for patients around the globe. Read More

News & Press Releases

Mounjaro and Zepbound generated a combined $11.7 billion in sales for the company in its most recent quarter.

Via The Motley Fool · February 9, 2026

The multi-billion dollar weight-loss drug market experienced a seismic shift this morning as the era of easy-access compounded alternatives faced its most significant legal and regulatory challenge to date. On February 9, 2026, pharmaceutical giant Novo Nordisk (NYSE: NVO) filed a landmark patent infringement lawsuit against Hims & Hers Health, Inc.

Via MarketMinute · February 9, 2026

Novo Nordisk just did Eli Lilly stock a huge favor.

Via The Motley Fool · February 9, 2026

FDA "Swift Action" Warning Sends Hims & Hers into a Tailspinchartmill.com

Via Chartmill · February 9, 2026

As the S&P 500 (INDEXSP: .INX) pushes toward the 7,100 mark in early 2026, a growing chorus of investors is nervously glancing back at the ghosts of 1999. With the index having notched double-digit gains in 2025, driven by the relentless expansion of artificial intelligence and high-cap technology

Via MarketMinute · February 9, 2026

The meteoric rise of telehealth giant Hims & Hers Health (NYSE: HIMS) faced its most severe reckoning this week, as the company’s stock plummeted to a one-year low following a dramatic withdrawal of its highly anticipated oral weight-loss treatment. What was intended to be a disruptive move against the pharmaceutical

Via MarketMinute · February 9, 2026

On February 9, 2026, the telehealth landscape faces a reckoning. Hims & Hers Health (NYSE: HIMS), a company that once seemed invincible during the weight-loss drug gold rush of 2025, is currently grappling with a sharp 20% decline in its stock price over the past week. The catalyst for this sudden valuation haircut is a [...]

Via Finterra · February 9, 2026

Eli Lilly shares rise after announcing a $2.4 billion deal to buy Orna Therapeutics, strengthening its push into genetic medicine despite mixed markets.

Via Benzinga · February 9, 2026

Monday's pre-market session: top gainers and losers in the S&P500 indexchartmill.com

Via Chartmill · February 9, 2026

The acquisition will strengthen Lilly’s pipeline with a new class of therapies built on engineered circular RNA and proprietary lipid nanoparticles.

Via Stocktwits · February 9, 2026

Dow 50,000: A Milestone for the History Books Amidst an AI Spending Warchartmill.com

Via Chartmill · February 9, 2026

Retail bulls pointed to similar price levels during high short interest in late 2024 and said ending compounded sales removes the risk of a costly legal fight.

Via Stocktwits · February 8, 2026

It doesn't look too late to buy the stock.

Via The Motley Fool · February 8, 2026

Retirees should brace themselves for both positive and negative changes to Medicare this year.

Via The Motley Fool · February 8, 2026

Eli Lilly is the leader in the GLP-1 space, but here's another GLP-1 stock and a medical device maker to consider.

Via The Motley Fool · February 7, 2026

The most recent gold rush in weight loss drugs isn't done just yet.

Via The Motley Fool · February 7, 2026

Tom Lee says the S&P 500 (a benchmark for the U.S. stock market) can hit 15,000 by 2030.

Via The Motley Fool · February 7, 2026

Via MarketBeat · February 6, 2026

Eli Lilly and Company (NYSE: LLY) has officially entered the "trillion-dollar club" with a roar, issuing a blockbuster financial guidance for 2026 that projects revenue between $80 billion and $83 billion. The announcement, made during the company’s early February earnings call, marks a historic turning point in the pharmaceutical

Via MarketMinute · February 6, 2026

Biogen Inc. (NASDAQ: BIIB) reported its fourth-quarter and full-year 2025 financial results on February 6, 2026, signaling a definitive shift from a legacy company plagued by patent cliffs to a leaner, growth-oriented neurology powerhouse. Despite a 7% year-over-year revenue decline to $2.28 billion, the company beat Wall Street expectations

Via MarketMinute · February 6, 2026

The market for obesity drugs may soon reach almost $100 billion.

Via The Motley Fool · February 6, 2026

In a breakthrough that many are calling the "Penicillin Moment" of the 21st century, researchers at the Massachusetts Institute of Technology, led by bioengineering pioneer James Collins, have successfully leveraged generative AI to discover an entirely new class of antibiotics capable of neutralizing the deadly, drug-resistant superbug MRSA. This development, which reached a critical clinical [...]

Via TokenRing AI · February 6, 2026

The long-standing duopoly of the weight-loss drug market faced its most significant challenge yet this week as Hims & Hers Health, Inc. (NYSE: HIMS) announced a breakthrough $49 compounded oral semaglutide pill. The move, aimed directly at the market share of pharmaceutical titans Eli Lilly and Company (NYSE: LLY) and Novo

Via MarketMinute · February 6, 2026

The drugmaker is facing pricing pressures on its weight loss medications.

Via The Motley Fool · February 6, 2026

The global race for obesity market dominance reached a historic turning point this week as Eli Lilly and Company (NYSE: LLY) officially crossed the $1 trillion market capitalization threshold, cementing its status as the world’s most valuable healthcare entity. The milestone follows a stellar 2026 guidance report that projected

Via MarketMinute · February 6, 2026