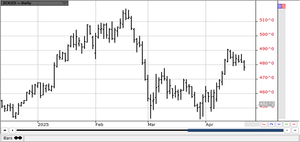

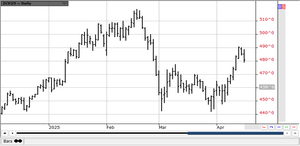

Teucrium Corn Fund ETV (CORN)

17.66

+0.11 (0.63%)

NYSE · Last Trade: Oct 2nd, 4:14 PM EDT

Detailed Quote

| Previous Close | 17.55 |

|---|---|

| Open | 17.50 |

| Day's Range | 17.49 - 17.71 |

| 52 Week Range | 16.61 - 20.69 |

| Volume | 96,937 |

| Market Cap | 445.92K |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 73,006 |

Chart

News & Press Releases

September 2025 concluded with a stark divergence in the global commodity markets, painting a clear picture of winners and losers driven by a confluence of macroeconomic shifts, geopolitical uncertainties, and fundamental supply-demand dynamics. While precious metals staged an impressive rally, reaching multi-year and even all-time highs, the agricultural sector, particularly

Via MarketMinute · October 1, 2025

Trump's comments about a possible switch to cane sugar for Coca-Cola could have major implications for commodity markets and ETF investors, causing turmoil and possible job losses.

Via Benzinga · July 18, 2025

The week so far has been a battle against broadly favorable Central U.S. and Brazilian weather against potential record-low old crop exporter stocks/use and unhindered near-term U.S. export demand.

Via Talk Markets · April 25, 2025

Rice closed a little lower again on follow through selling.

Via Talk Markets · April 25, 2025

Cotton was higher as demand ideas got help when Mr. Trump dialed back on his tariff threats and threats on the independence of the Fed.

Via Talk Markets · April 24, 2025

Global corn futures ended weaker, while Argentine/Ukraine fob premiums firmed slightly.

Via Talk Markets · April 24, 2025

May Beans have been confined to a tight 20 cent range in the past 8 trading days.

Via Talk Markets · April 23, 2025

The CBOT corn futures fell 6-7 cents amid building chart resistance at $4.90-$4.95, basis July.

Via Talk Markets · April 23, 2025

CBOT corn ended unchanged despite another day of collapsing financial markets.

Via Talk Markets · April 22, 2025

Gold prices surged to fresh highs amid concerns about the US Federal Reserve’s independence. Oil and other risk assets, however, are under pressure amid heightened global uncertainty.

Via Talk Markets · April 22, 2025

Rice closed lower but futures are still holding to a sideways trend.

Via Talk Markets · April 21, 2025

A creeping rotation out of U.S. assets and a subtle, but steady, rethink of the dollar as the default global parking spot.

Via Talk Markets · April 18, 2025

CBOT corn futures ended higher amid hope U.S. Ag avoids potential surcharges on Chinese-made vessels at U.S. ports.

Via Talk Markets · April 17, 2025

Remarkably, May Beans have managed to rally 90 cents (970-1050) this month despite the massive tariffs against China – as other countries have stepped up their exports.

Via Talk Markets · April 16, 2025

Rice closed higher again and are holding to a sideways to up trend.

Via Talk Markets · April 15, 2025

Global corn futures ended weaker as market risk was shed.

Via Talk Markets · April 15, 2025

CBOT corn ended sharply higher amid a further collapse in the U.S. dollar and the lack of retaliation from importers.

Via Talk Markets · April 14, 2025

May Corn has displayed impressive bullish divergence – rallying 30 cents off its trading range lows – despite the tariffs.

Via Talk Markets · April 10, 2025

Rice closed higher again as the U.S. will negotiate on tariffs with all countries except China.

Via Talk Markets · April 10, 2025

CBOT corn extended its AM rally as the US’s trade war is at a pause – at least for the next 90-days – transferring its weight on China exclusively.

Via Talk Markets · April 10, 2025

Trump surprised markets with a 90-day pause in reciprocal tariffs for most trading partners. This provided a boost to risk assets, including commodities. However, there’s still plenty of uncertainty as the US again increased tariffs on China.

Via Talk Markets · April 10, 2025

Cotton was lower in a further response to the Trump tariffs that threaten to greatly increase the costs of imports from China and Vietnam among other things.

Via Talk Markets · April 9, 2025

CBOT corn ended higher for a second day following FAS announcing Spain overnight purchased 240,000 MT’s of U.S. origin.

Via Talk Markets · April 9, 2025

CBOT corn futures higher despite chaos in global financial markets.

Via Talk Markets · April 8, 2025

Risk of further escalation in trade tensions between the US and China poses increased downside risks to the commodities complex.

Via Talk Markets · April 8, 2025