Fuel cell technology Plug Power (NASDAQ:PLUG) beat Wall Street’s revenue expectations in Q2 CY2025, with sales up 21.4% year on year to $174 million. Its GAAP loss of $0.20 per share was 32.6% below analysts’ consensus estimates.

Is now the time to buy Plug Power? Find out by accessing our full research report, it’s free.

Plug Power (PLUG) Q2 CY2025 Highlights:

- Revenue: $174 million vs analyst estimates of $157.6 million (21.4% year-on-year growth, 10.4% beat)

- EPS (GAAP): -$0.20 vs analyst expectations of -$0.15 (32.6% miss)

- Adjusted EBITDA: -$149.1 million vs analyst estimates of -$118.3 million (-85.7% margin, 26% miss)

- Operating Margin: -102%, up from -171% in the same quarter last year

- Free Cash Flow was -$230.4 million compared to -$356 million in the same quarter last year

- Market Capitalization: $1.70 billion

Company Overview

Powering forklifts for Walmart’s distribution centers, Plug Power (NASDAQ:PLUG) provides hydrogen fuel cells used to power electric motors.

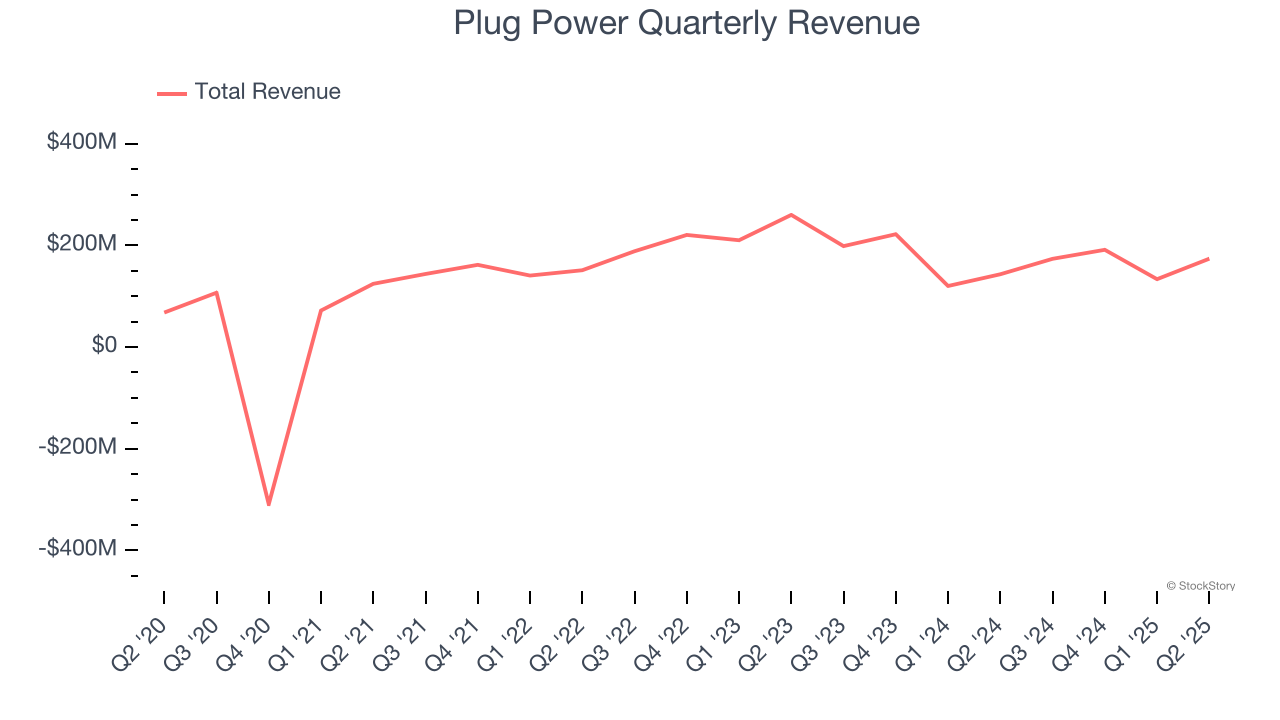

Revenue Growth

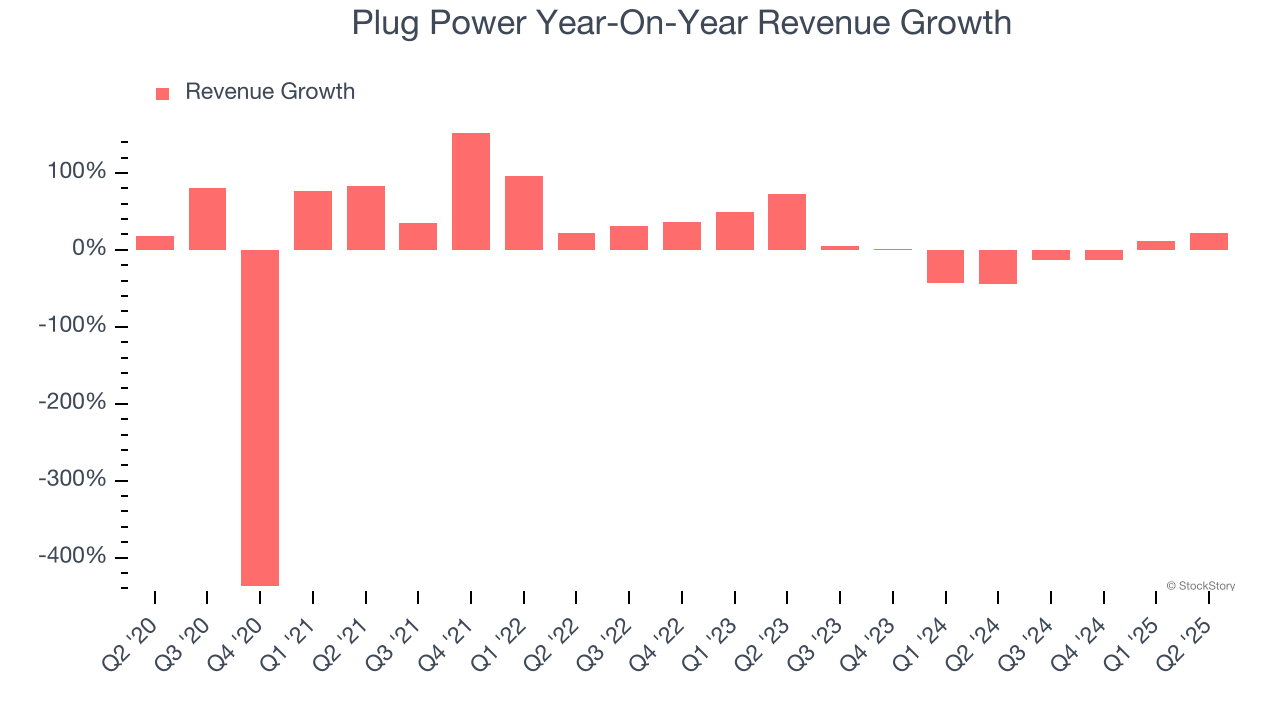

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Plug Power grew its sales at an incredible 21% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Plug Power’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 12.6% over the last two years. Plug Power isn’t alone in its struggles as the Renewable Energy industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Plug Power reported robust year-on-year revenue growth of 21.4%, and its $174 million of revenue topped Wall Street estimates by 10.4%.

Looking ahead, sell-side analysts expect revenue to grow 23.7% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and implies its newer products and services will fuel better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Plug Power’s high expenses have contributed to an average operating margin of negative 190% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, Plug Power’s operating margin decreased significantly over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Plug Power’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Plug Power generated a negative 102% operating margin.

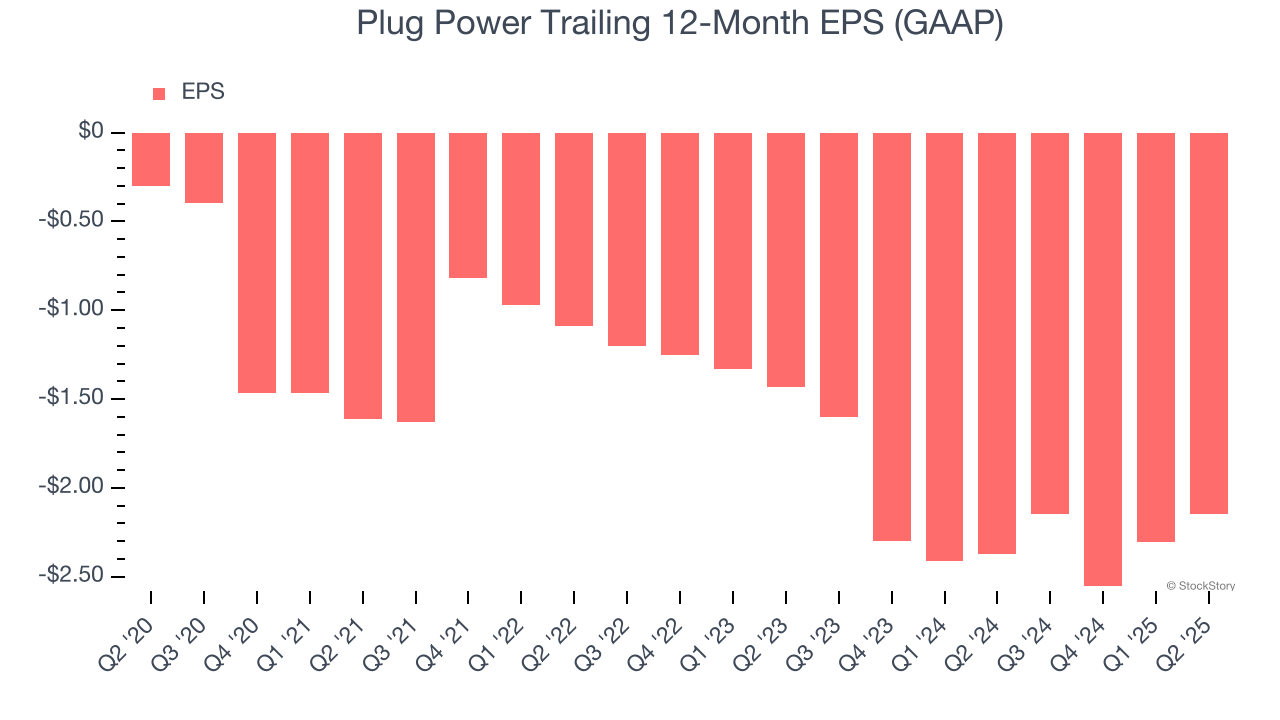

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Plug Power’s earnings losses deepened over the last five years as its EPS dropped 48.2% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Plug Power’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Plug Power, its two-year annual EPS declines of 22.5% show it’s still underperforming. These results were bad no matter how you slice the data.

In Q2, Plug Power reported EPS at negative $0.20, up from negative $0.36 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Plug Power’s full-year EPS of negative $2.14 will reach break even.

Key Takeaways from Plug Power’s Q2 Results

We were impressed by how significantly Plug Power blew past analysts’ revenue expectations this quarter. On the other hand, its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 6% to $1.50 immediately following the results.

Plug Power’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.