3D printing company 3D Systems (NYSE:DDD) missed Wall Street’s revenue expectations in Q2 CY2025, with sales falling 16.3% year on year to $94.84 million. Its non-GAAP loss of $0.07 per share was 54.8% above analysts’ consensus estimates.

Is now the time to buy 3D Systems? Find out by accessing our full research report, it’s free.

3D Systems (DDD) Q2 CY2025 Highlights:

- Revenue: $94.84 million vs analyst estimates of $95.78 million (16.3% year-on-year decline, 1% miss)

- Adjusted EPS: -$0.07 vs analyst estimates of -$0.16 (54.8% beat)

- Adjusted EBITDA: -$5.3 million vs analyst estimates of -$13.67 million (-5.6% margin, 61.2% beat)

- Operating Margin: -16.2%, up from -23.3% in the same quarter last year

- Free Cash Flow was -$28.79 million compared to -$14.72 million in the same quarter last year

- Market Capitalization: $242.8 million

Dr. Jeffrey Graves, president and CEO of 3D Systems said, “We delivered improved profitability in the second quarter, reflecting an intense focus on our cost structure and operational efficiencies, in the face of a continuously challenging macroeconomic climate for our industry. Our cost savings initiatives, which we first announced in March, favorably impacted both gross margins and operating expenses on a sequential basis for the second quarter. Key elements of our cost and efficiency initiative include consolidation of our operational footprint, restructuring of our workforce, and various efficiency initiatives across the business. As announced, these savings initiatives will extend through mid-2026, paced in part by the rate at which real-estate leases for exited facilities are curtailed. We are benefiting from our prior efforts to fully in-source manufacturing and supply chain operations, an initiative which is now virtually complete and helping to offset headwinds from tariffs. In the second quarter, tariffs increased our costs by roughly $1 million, but were largely countered through improved operating efficiencies in manufacturing operations which supported our gross margin performance. Looking ahead we expect the impact of tariffs to continue impacting our operating costs as we move through the second half of the year.”

Company Overview

Founded by the inventor of stereolithography, 3D Systems (NYSE:DDD) engineers, manufactures, and sells 3D printers and other related products to the aerospace, automotive, healthcare, and consumer goods industries.

Revenue Growth

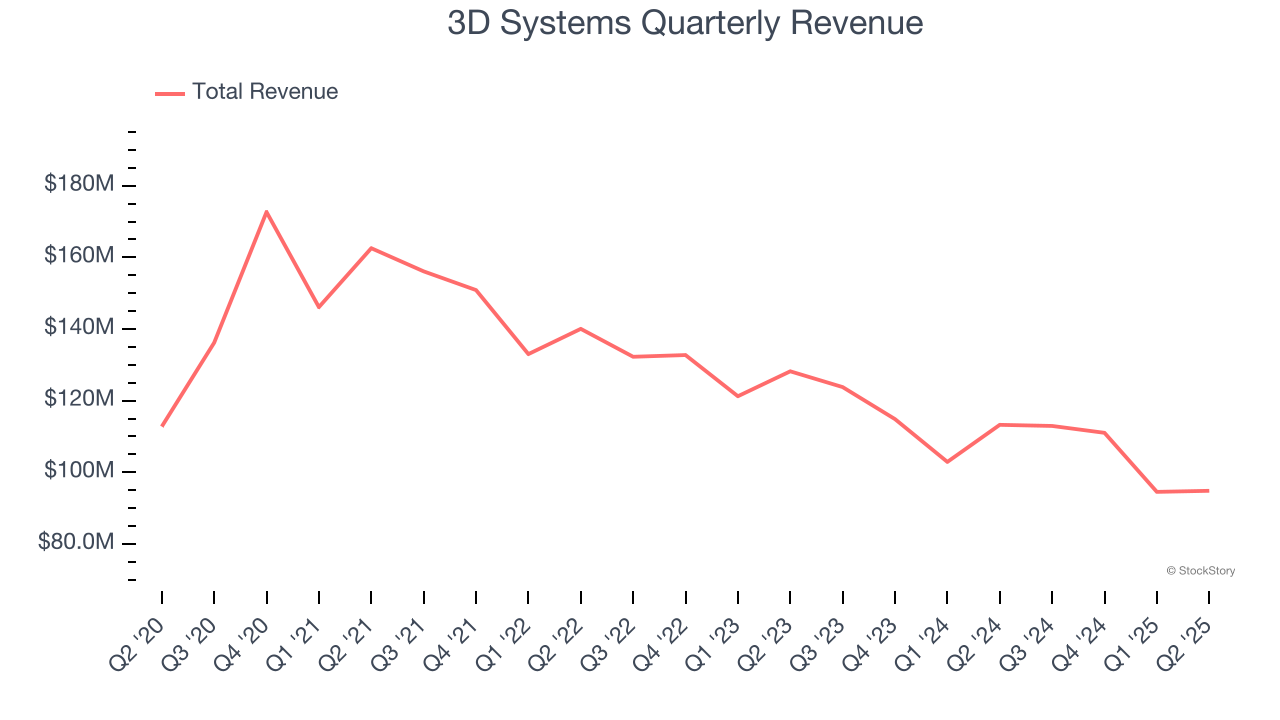

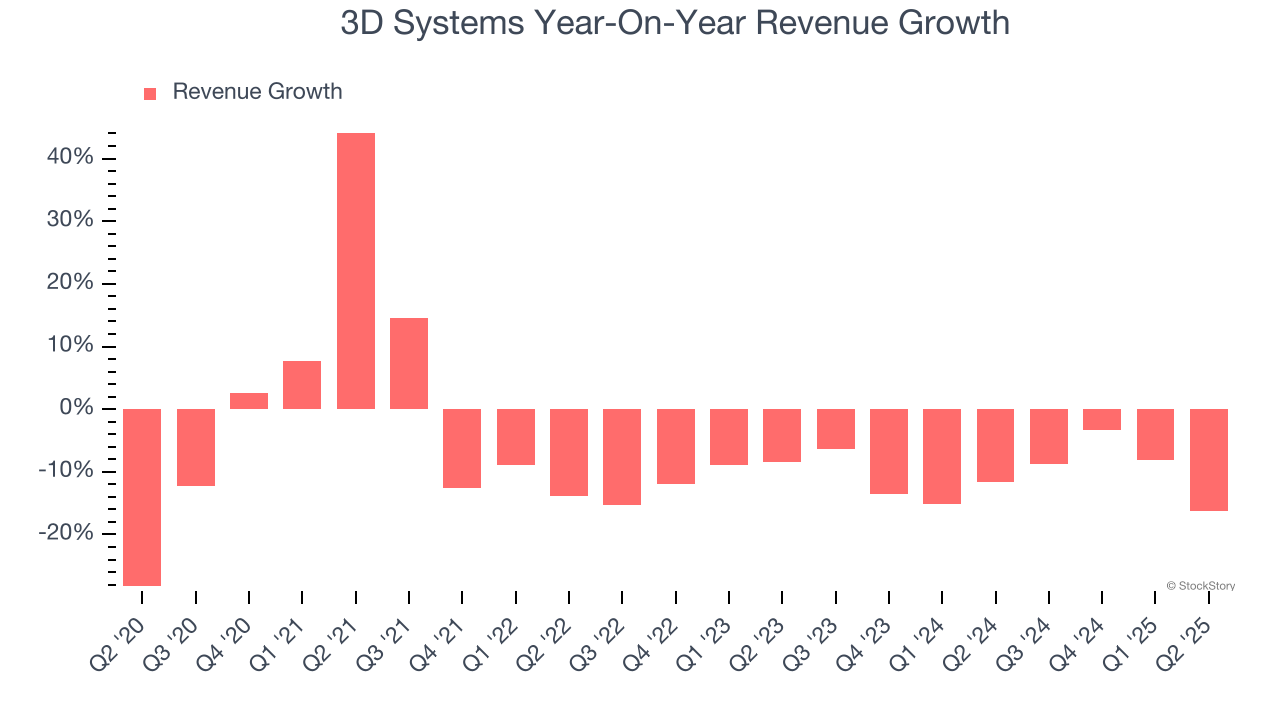

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, 3D Systems’s demand was weak and its revenue declined by 6.3% per year. This wasn’t a great result and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. 3D Systems’s recent performance shows its demand remained suppressed as its revenue has declined by 10.4% annually over the last two years.

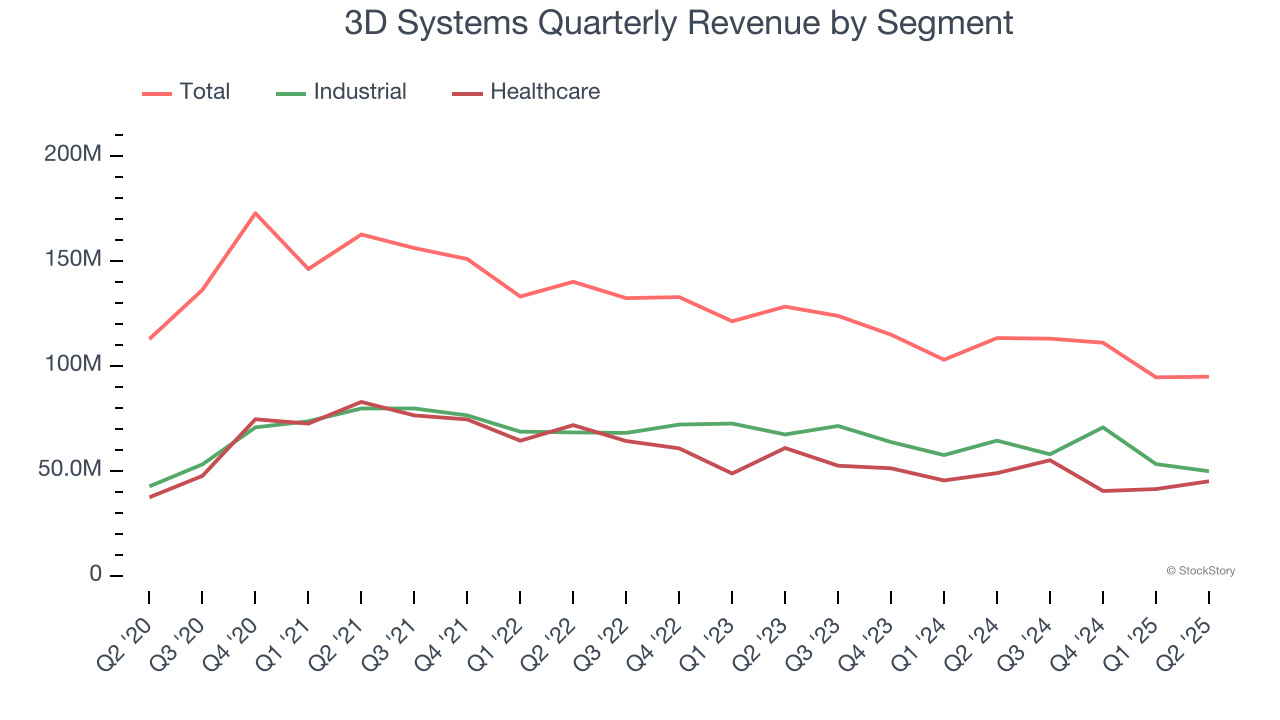

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Industrial and Healthcare, which are 52.5% and 47.5% of revenue. Over the last two years, 3D Systems’s Industrial revenue (aerospace, defense, and transportation manufacturing) averaged 8.7% year-on-year declines while its Healthcare revenue (dental and medical devices) averaged 11.7% declines.

This quarter, 3D Systems missed Wall Street’s estimates and reported a rather uninspiring 16.3% year-on-year revenue decline, generating $94.84 million of revenue.

Looking ahead, sell-side analysts expect revenue to decline by 1.3% over the next 12 months. Although this projection is better than its two-year trend, it’s hard to get excited about a company that is struggling with demand.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

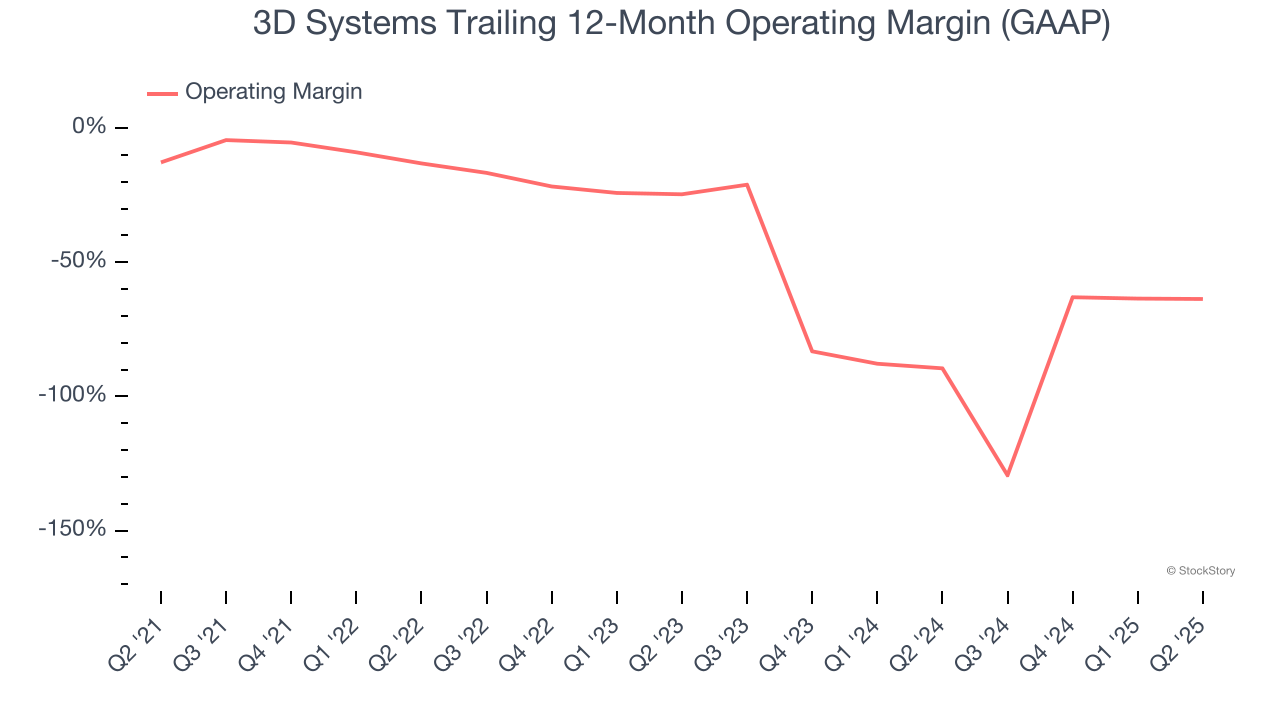

3D Systems’s high expenses have contributed to an average operating margin of negative 36.9% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, 3D Systems’s operating margin decreased by 50.9 percentage points over the last five years. 3D Systems’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q2, 3D Systems generated a negative 16.2% operating margin. The company's consistent lack of profits raise a flag.

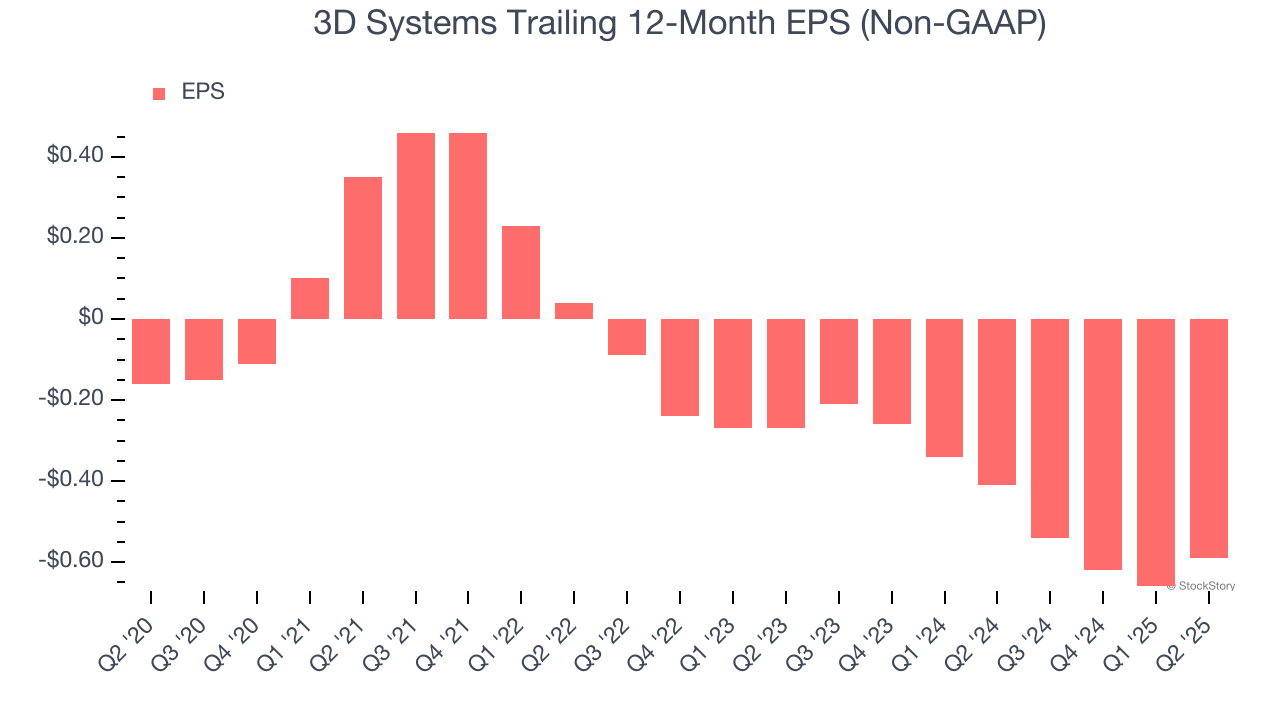

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

3D Systems’s earnings losses deepened over the last five years as its EPS dropped 29.8% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, 3D Systems’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For 3D Systems, its two-year annual EPS declines of 47.8% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q2, 3D Systems reported adjusted EPS at negative $0.07, up from negative $0.14 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street is optimistic. Analysts forecast 3D Systems’s full-year EPS of negative $0.59 will reach break even.

Key Takeaways from 3D Systems’s Q2 Results

We were impressed by how significantly 3D Systems blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its revenue slightly missed. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 4% to $1.82 immediately following the results.

Indeed, 3D Systems had a rock-solid quarterly earnings result, but is this stock a good investment here? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.