Looking back on therapeutics stocks’ Q2 earnings, we examine this quarter’s best and worst performers, including Myriad Genetics (NASDAQ:MYGN) and its peers.

Over the next few years, therapeutic companies, which develop a wide variety of treatments for diseases and disorders, face strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

The 9 therapeutics stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 5.1%.

Luckily, therapeutics stocks have performed well with share prices up 18.9% on average since the latest earnings results.

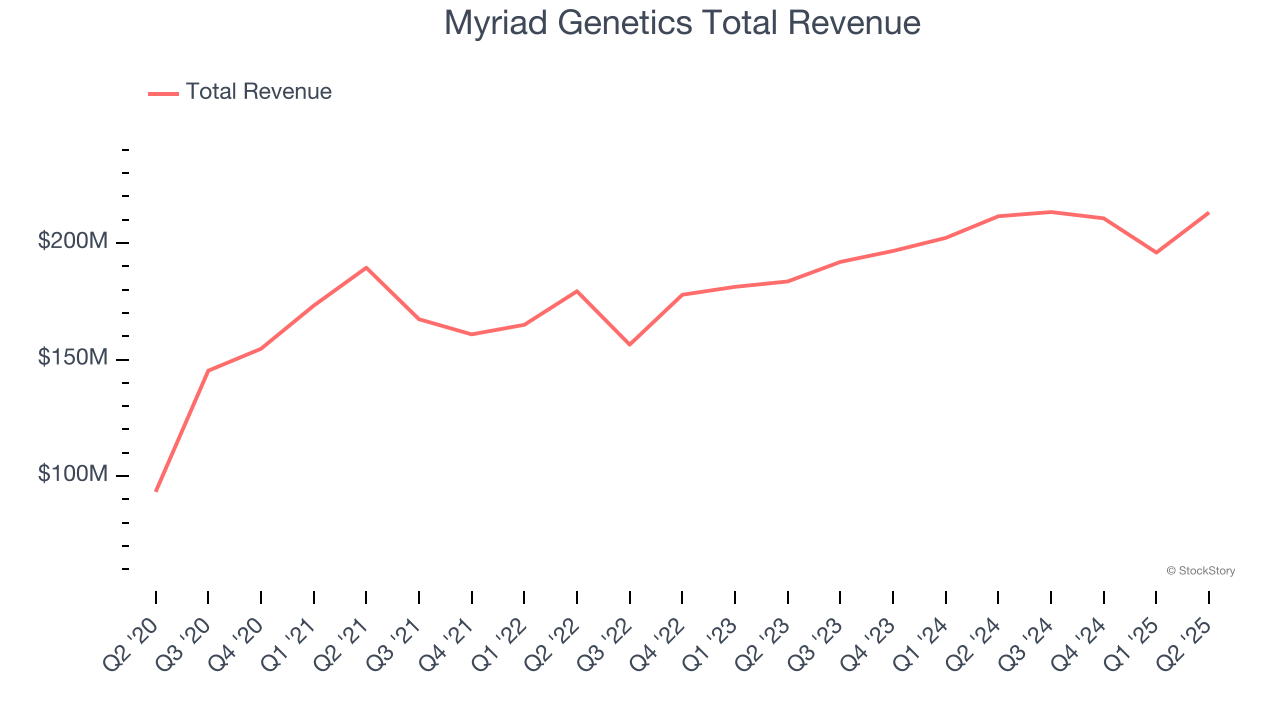

Myriad Genetics (NASDAQ:MYGN)

Founded in 1991 as one of the pioneers in translating genetic discoveries into clinical applications, Myriad Genetics (NASDAQ:MYGN) develops genetic tests that assess disease risk, guide treatment decisions, and provide insights across oncology, women's health, and mental health.

Myriad Genetics reported revenues of $213.1 million, flat year on year. This print exceeded analysts’ expectations by 5.5%. Overall, it was a stunning quarter for the company with a beat of analysts’ EPS estimates and full-year EBITDA guidance exceeding analysts’ expectations.

"We delivered solid second-quarter results, driven by continued strength in hereditary cancer testing in oncology, improving momentum in hereditary cancer testing for unaffected individuals, and favorable pricing trends supported by mix and our ongoing efforts to expand payer coverage. Our disciplined approach to expense management contributed to our improved profitability while we continued to invest in strategic drivers to enable long-term growth," said Sam Raha, President and CEO, of Myriad Genetics.

Myriad Genetics scored the highest full-year guidance raise of the whole group. Unsurprisingly, the stock is up 100% since reporting and currently trades at $7.73.

Is now the time to buy Myriad Genetics? Access our full analysis of the earnings results here, it’s free.

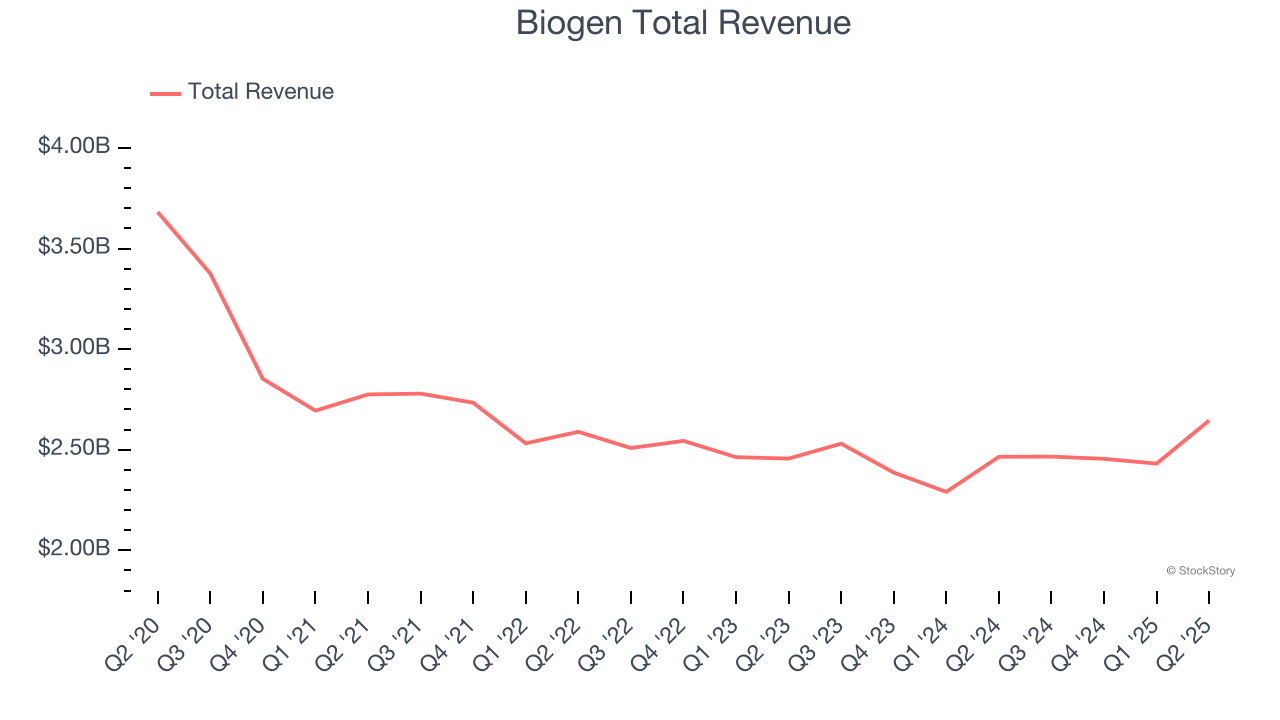

Best Q2: Biogen (NASDAQ:BIIB)

Founded in 1978 and pioneering treatments for some of medicine's most complex challenges, Biogen (NASDAQ:BIIB) develops and markets therapies for neurological conditions, including multiple sclerosis, Alzheimer's disease, spinal muscular atrophy, and rare diseases.

Biogen reported revenues of $2.65 billion, up 7.3% year on year, outperforming analysts’ expectations by 13.7%. The business had an incredible quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ full-year EPS guidance estimates.

Biogen delivered the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 23.1% since reporting. It currently trades at $156.31.

Is now the time to buy Biogen? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: United Therapeutics (NASDAQ:UTHR)

Founded by a mother seeking treatment for her daughter's pulmonary arterial hypertension, United Therapeutics (NASDAQ:UTHR) develops and commercializes medications for chronic lung diseases and other life-threatening conditions, with a focus on pulmonary hypertension treatments.

United Therapeutics reported revenues of $798.6 million, up 11.7% year on year, falling short of analysts’ expectations by 0.5%. It was a softer quarter as it posted a significant miss of analysts’ EPS estimates.

United Therapeutics delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 48.1% since the results and currently trades at $440.00.

Read our full analysis of United Therapeutics’s results here.

BioMarin Pharmaceutical (NASDAQ:BMRN)

Pioneering treatments for conditions that often had no previous therapeutic options, BioMarin Pharmaceutical (NASDAQ:BMRN) develops and commercializes therapies that address the root causes of rare genetic disorders, particularly those affecting children.

BioMarin Pharmaceutical reported revenues of $825.4 million, up 15.9% year on year. This number beat analysts’ expectations by 8.4%. It was an exceptional quarter as it also logged a beat of analysts’ EPS estimates.

BioMarin Pharmaceutical pulled off the fastest revenue growth among its peers. The stock is down 10.1% since reporting and currently trades at $54.25.

Read our full, actionable report on BioMarin Pharmaceutical here, it’s free.

AbbVie (NYSE:ABBV)

Born from a 2013 spinoff of Abbott Laboratories' pharmaceutical business, AbbVie (NYSE:ABBV) is a biopharmaceutical company that develops and markets medications for autoimmune diseases, cancer, neurological disorders, and other complex health conditions.

AbbVie reported revenues of $15.42 billion, up 6.6% year on year. This result surpassed analysts’ expectations by 2.6%. Overall, it was a strong quarter as it also put up a solid beat of analysts’ constant currency revenue and EPS estimates.

The stock is up 28.8% since reporting and currently trades at $243.85.

Read our full, actionable report on AbbVie here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.