- Secures a premier long-term strategic partner in Mitsubishi, which has a long history of joint venture partnerships in the highest quality copper mines globally

- Mitsubishi's strategic partnership validates the attractive long-term value of Copper World as a world-class copper asset and endorses the strong technical capabilities of Hudbay

- Facilitates approximately $1.5 billion investment in the U.S. critical minerals supply chain to deliver an anticipated 85,000 tonnes of "Made in America" copper production annually for 20 yearsi

- Copper World is expected to create more than 1,000 jobs during project construction with 400 direct jobs and up to 3,000 indirect jobs once in full production

- Mitsubishi's initial investment of $600 million and pro-rata equity capital contributions provide significant financial flexibility by reducing Hudbay's estimated share of the remaining capital contributions to approximately $200 million based on PFS estimates

- Defers Hudbay's first capital contribution to 2028 at the earliest based on PFS estimates

- Increases levered project IRR to Hudbay to approximately 90% based on PFS estimatesii

- Agreed on terms for an enhanced precious metals stream with Wheaton which contemplates up to $70 million contingent payment that recognizes long-term potential of Copper World in addition to initial $230 million stream deposit

- Transaction would achieve the key funding elements in Hudbay's 3-P prudent financing framework for the development of Copper World

TORONTO, Aug. 13, 2025 (GLOBE NEWSWIRE) -- Hudbay Minerals Inc. (“Hudbay” or the “Company”) (TSX, NYSE: HBM) is pleased to announce that Mitsubishi Corporation (“Mitsubishi”) has agreed to acquire a 30% interest in Copper World LLC, a wholly-owned subsidiary of Hudbay which owns the fully-permitted Copper World project in Arizona (“Copper World”) for an initial cash contribution of $600 million, comprising $420 million as consideration for a 30% equity interest in Copper World at closing and $180 million as a matching contribution within 18 months of closing (the “JV Transaction”). The JV Transaction is subject to the satisfaction of customary closing conditions. All dollar amounts are in U.S. dollars, unless otherwise noted.

“Securing Mitsubishi as a 30% partner in Copper World is an important milestone for Hudbay as we establish a long-term strategic partnership to advance this high-quality copper project towards sanctioning and to unlock significant value in our copper growth portfolio," said Peter Kukielski, Hudbay's President and Chief Executive Officer. "I have a long history of involvement with joint ventures over my career, including with Mitsubishi at Antamina back in the 1990s and 2000s, and I’ve seen how strategic joint ventures have built some of the best mines in the world. After a highly robust and competitive process, we have selected the premier partner of choice in Mitsubishi. Through this partnership we will leverage our complementary strengths to deliver our world-class Copper World project, produce domestic copper in the U.S. for the U.S. critical minerals supply chain and create value for all our stakeholders. We have also agreed to modernize the Wheaton precious metals stream, which, together with the recent achievement of our balance sheet targets, will complete the key elements of our prudent financing plan for Copper World, and we are very well positioned to build one of the next major copper mines in the U.S."

"Participation in Copper World is of significant strategic importance for Mitsubishi towards the realization of its growth strategy within the copper sector. We are pleased to collaborate with Hudbay, whose operational and development expertise is well-recognized and proven, to advance a definitive feasibility study. Drawing on our knowledge in copper mining investment developed through partnerships with global mining companies, and extensive business experience in North America developed over many years across diverse sectors including mineral resources trading, we aim to unlock the full potential of Copper World together with Hudbay," said Taro Abe, Mitsubishi's Critical Minerals Division COO, Mineral Resources Group.

Hudbay Significantly De-risks Copper World and Advances Towards a Sanction Decision in 2026

- Realizes Attractive Valuation for Copper World Strategic Investment – $600 million Copper World JV Transaction with Mitsubishi for a 30% minority interest.

- Implies a significant premium to consensus net asset value for Copper Worldiii.

- Mitsubishi's $600 million initial investment will consist of $420 million at closing and $180 million within 18 months of closing.

- Mitsubishi will also fund its pro-rata 30% share of future equity capital contributions.

- Increases levered project IRR to Hudbay to approximately 90% based on pre-feasibility study ("PFS") estimatesii.

- Secures The Premier Joint Venture Partner – Secures a long-term strategic partner in Mitsubishi, one of the largest Japanese trading houses with a global mining presence and a significant U.S. based business.

- Mitsubishi is the strategic partner of choice with investments in a world-class portfolio of large and high-quality copper assets, including five of the top twenty copper mines globally by 2024 production.

- Mitsubishi's wholly-owned U.S. subsidiary, Mitsubishi Corporation (Americas), has over 50 subsidiaries and affiliates across various business sectors, including mineral resources, oil & gas, real estate, mobility, food, power, etc., and manages the company's strategic investments with approximately $9 billion in total assets and trading businesses in North America, which encompass trading activity with a substantial volume of copper, precious metals, and aluminum in the U.S. market.

- Strategic partnership validates the attractive long-term value of Copper World as a world-class copper asset and endorses the strong technical capabilities of Hudbay.

- Enhances Stream – Agreed on terms with Wheaton Precious Metals Corp. (“Wheaton”) to amend the existing precious metals streaming agreement.

- In addition to the initial $230 million stream deposit, provides an additional contingent payment of up to $70 million on a future potential mill expansion recognizing the long-term potential at Copper World.

- Ongoing payments for gold and silver amended from fixed pricing to 15% of spot prices to provide upside exposure to higher precious metals prices.

- Updated structure aligns with the current development plan for Copper World and the joint venture agreement.

- Achieves 3-P Plan with Significant Financial Flexibility for Development – Successfully completes key elements of Hudbay’s prudent financial strategy as part of the three prerequisites (“3-P”) plan for Copper World with the announcements of the JV Transaction and the enhanced Wheaton stream, together with the achievement of stated balance sheet targets.

- Before accounting for proceeds from this Transaction, Hudbay has already achieved more than $600 million of cash and cash equivalents and a 0.4x net debt to adjusted EBITDA ratioiv, as of June 30, 2025, far exceeding the stated balance sheet targets.

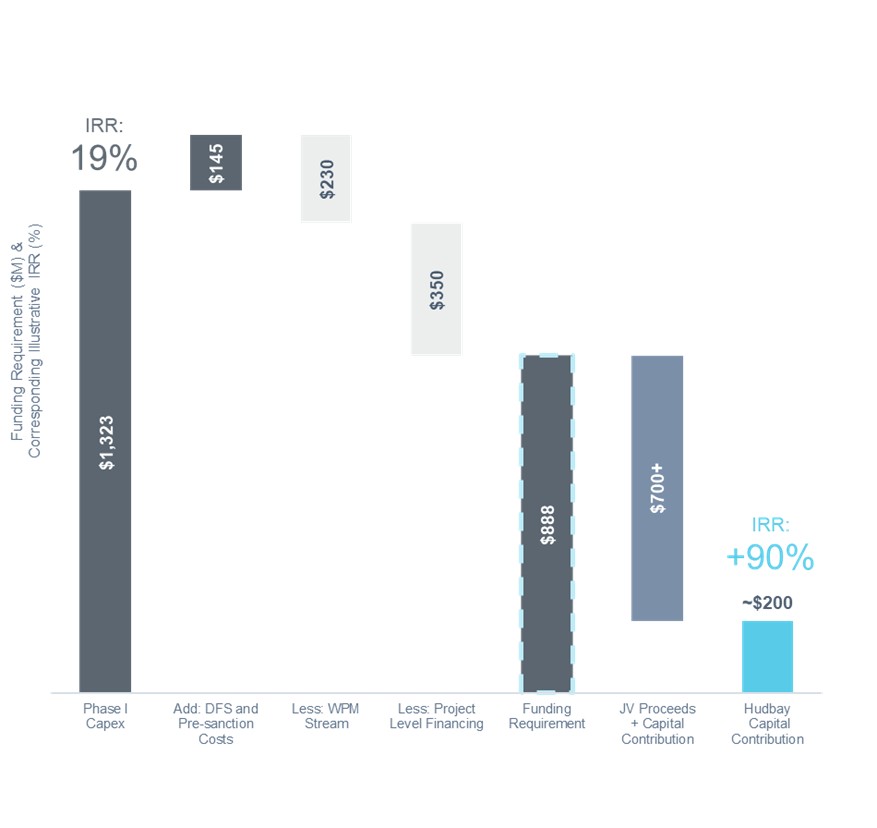

- The Mitsubishi initial investment and its pro-rata equity capital contributions, together with the amended Wheaton stream, provide significant financial flexibility by reducing Hudbay's estimated share of the remaining capital contributions to approximately $200 million based on PFS estimates, as shown in Figure 1, and defers Hudbay's first capital contribution until 2028 at the earliest.

- DFS and Detailed Engineering Underway - Well positioned to advance Copper World towards a sanction decision in 2026.

- Feasibility study for Copper World is underway with expected completion of a definitive feasibility study ("DFS") by mid-2026.

- With this successful de-risking milestone at Copper World, Hudbay expects to accelerate detailed engineering, some key long lead items and other de-risking activities by advancing $20 million in growth capital expenditures to 2025 from future years, and is updating total 2025 Arizona growth spending guidance to $110 million from $90 million on a 100% basis.

Major Investment in the U.S. Critical Minerals Supply Chain

Copper World will support the U.S. Government's foreign investment and national security objectives with a projected direct $1.5 billion investment into the U.S. critical minerals supply chain, which will also represent one of largest investments in southern Arizona's history. Hudbay, as the fourth largest copper company listed on the NYSE and with a majority of shareholders domiciled in the U.S., is pleased to advance America’s next major copper mine, a critical minerals project that underpins the U.S. as a global leader in copper production. Hudbay is supported by a partner with a large operational footprint in the U.S., deep ties to the domestic economy and a history of significant investment into the U.S.

The fully permitted initial phase of the Copper World project is located on private land owned by Hudbay. The mine is expected to produce 85,000 tonnes of copper per year over an initial 20-year mine life. During the three-year construction period, Copper World is expected to create more than 1,000 jobs annually and intends to engage union labor for project construction with letters of commitments currently in place with seven U.S. labor unions. Once in production, Copper World is also expected to contribute over $850 millionv in U.S. taxes and create more than 400 direct jobs and 3,000 indirect jobs in Arizona. Copper World’s “Made in America” copper production will contribute to the domestic U.S. copper supply chain and strengthen manufacturing capacity, national security and energy independence.

Secured Premier Long-term Strategic Partner in JV Transaction

The joint venture will be structured as a new limited liability corporation, Copper World LLC. Under the JV Transaction, the initial contribution of $600 million for a 30% equity interest in Copper World LLC, will consist of $420 million upon closing and a $180 million matching contribution payable no later than 18 months following closing. Hudbay will retain 100% of its existing U.S. federal net operating losses of approximately $275 million and Arizona state losses of $210 million.

Hudbay welcomes a premier, long-term, strategic partner with deep technical expertise and a proven trading platform which Mitsubishi has established throughout its demonstrated history of industry partnerships. Mitsubishi’s impressive track record in co-developing and operating some of the world’s largest and highest quality copper projects will complement Hudbay's proven track record as a successful mine builder and operator.

Mitsubishi will be contributing 30% of the ongoing costs beginning August 31, 2025 and will participate in the funding of the DFS as well as the final project design, project financing, and project construction for Copper World.

The JV Transaction is expected to close in late 2025 or early 2026 and is conditioned upon receipt of certain regulatory approvals and the satisfaction of other customary closing conditions.

Enhanced Wheaton Precious Metals Stream

Hudbay is also pleased to announce that it has concurrently executed a non-binding term sheet to amend its existing Wheaton stream agreement for 100% of the gold and silver produced at Copper World (the "Wheaton Stream"), which will increase the value of the project and provide upside exposure to higher precious metal prices.

Key terms of this enhanced Wheaton Stream to include (subject to execution of definitive documentation):

- Up to $70 million contingent payment upon achieving potential mill expansion milestones in the future recognizing the long-term potential at Copper World.

- Amended ongoing payments for gold and silver from a fixed price to 15% of spot gold and silver prices providing upside exposure to higher precious metals prices.

- Initial $230 million stream deposit during project construction remains unchanged.

- Hudbay agreed to maintain existing fixed recoveries in the existing Constancia precious metals stream while Pampacancha is in production as well as provided a corporate guarantee for the existing Constancia stream in connection with the Wheaton Stream enhancement.

About Copper World

The 100% owned Copper World project is located in Pima County, Arizona, approximately 50 kilometres southeast of Tucson. Copper World includes four deposits discovered in 2021, together with the East deposit (formerly known as the Rosemont deposit). A new resource model was completed for the preliminary economic assessment (“PEA”) of Copper World in 2022, which contemplated a two-phased mine plan with Phase I as a standalone operation requiring state and local permits only and Phase II expanding onto federal lands requiring federal permits.

In September 2023, Hudbay released its enhanced PFS for Copper World reflecting the results of further technical work on Phase I of the project. Phase I has a mine life of 20 years, which is four years longer than the Phase I mine life that was presented in the PEA, largely due to an increase in the capacity for tailings and waste deposition as a result of optimizing the site layout. Phase II is expected to involve an expansion onto federal lands with a significantly longer mine life and enhanced project economics. Phase II would be subject to the federal permitting process and was not included in the PFS results.

Based on the PFS, Phase I contemplates average annual copper production of 85,000 tonnes over a 20-year mine life, at average cash costs and sustaining cash costs of $1.47 and $1.81 per pound of copperiv, respectively. A variable cut-off grade strategy allows for higher mill head grades in the first ten years, which increases annual production to approximately 92,000 tonnes of copper at average cash costs and sustaining cash costs of $1.53 and $1.95 per pound of copperiv, respectively. Once in production, Copper World is expected to increase Hudbay’s consolidated copper production by more than 50%.

Based on the PFS, the estimated initial capital investment for Phase I of Copper World is approximately $1.3 billion, net of equipment financing, with an additional $0.4 billion in year four for the construction of a concentrate leach facility to produce copper cathode. After incorporating the proceeds from the Wheaton Stream, the initial capital cost estimate is $1.1 billion, resulting in a capital intensity of under $13,000 per tonne of annual copper production.

On a 100% basis and using a copper price of $3.75 per pound, the PFS projects an after-tax net present value (“NPV”) of Phase I using an 8% discount rate of $1.1 billion and an internal rate of return (“IRR”) of 19%.

Copper World is one of the highest-grade open pit copper projects in the Americasvi with proven and probable mineral reserves of 385 million tonnes at 0.54% copper. There remains approximately 60% of the total copper contained in measured and indicated mineral resources (exclusive of mineral reserves), providing significant potential for Phase II expansion and mine life extension. In addition, the inferred mineral resource estimates are at a comparable copper grade and provide significant upside potential.

About Mitsubishi

Mitsubishi is a globally integrated trading and investment company that develops and operates businesses across multiple industries. The company has 115 offices in more than 90 countries with approximately 80,000 employees on consolidated basis across the globe and a diversified business portfolio with eight Business Groups that operate across virtually every industry: Environmental Energy, Material Solution, Mineral Resources, Urban Development and Infrastructure, Mobility, Food Industry, Smart-Life Creation, and Power Solution. Mitsubishi has a significant presence in the U.S. with offices in New York, Washington D.C., Boston, Houston, Los Angeles, Seattle and Silicon Valley. Mitsubishi operates commodity trading under RtM (Resource to Market), wholly-owned subsidiary, having its key offices in New York, Tokyo, Singapore and London that leverages its global distribution capabilities to provide important raw materials including copper cathodes and concentrates, aluminum, iron ore, coal and precious metals around the globe.

Advisors

Barclays Capital Canada Inc. and TD Securities Inc. are acting as financial advisors to Hudbay and Sullivan & Cromwell LLP is acting as legal counsel to Hudbay in connection with these transactions.

Qualified Person and NI 43-101

The technical and scientific information in this news release related to the company’s Copper World project has been approved by Olivier Tavchandjian, P. Geo, Hudbay’s Senior Vice President, Exploration and Technical Services. Mr. Tavchandjian is a qualified person pursuant to Canadian Securities Administrators’ National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”).

A copy of the NI 43-101 technical report for the Copper World PFS is available on Hudbay’s SEDAR+ profile at www.sedarplus.ca and on Hudbay’s EDGAR profile at www.sec.gov.

Cautionary Note to United States Investors

This news release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. Canadian reporting requirements for disclosure of mineral properties are governed NI 43-101.

For this reason, information contained in this news release in respect of the Copper World project may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder. For further information on the differences between the disclosure requirements for mineral properties under the United States federal securities laws and NI 43-101, please refer to the company’s annual information form, a copy of which has been filed under Hudbay’s profile on SEDAR+ at www.sedarplus.ca and the company’s Form 40-F, a copy of which has been filed under Hudbay’s profile on EDGAR at www.sec.gov.

Forward-Looking Information

This news release contains forward-looking information within the meaning of applicable Canadian and United States securities legislation. Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans” or similar terminology. The forward-looking information contained herein is provided for the purpose of assisting readers in understanding management’s current expectations and plans relating to the future. Readers are cautioned that such information may not be appropriate for other purposes.

Forward-looking information includes, but is not limited to, the consummation and timing of the JV Transaction, the satisfaction of the conditions precedent to the JV Transaction, including but not limited to receipt of certain regulatory approvals, expectations regarding the anticipated benefits of the JV Transaction to Hudbay, Mitsubishi and the United States, the consummation and timing of the DFS, Hudbay’s expectations for the Copper World project, including its project sanctioning timelines, future spending, project economics, future production profile and life of mine plan, and the benefits, timing and consummation of the amended Wheaton Stream. Forward-looking information is not, and cannot be, a guarantee of future results or events. Forward-looking information is based on, among other things, opinions, assumptions, estimates and analyses that, while considered reasonable at the date the forward-looking information is provided, inherently are subject to significant risks, uncertainties, contingencies and other factors that may cause actual results and events to be materially different from those expressed or implied by the forward-looking information.

The material factors or assumptions that Hudbay identified and were applied in drawing conclusions or making forecasts or projections set out in the forward-looking information include, but are not limited to, the closing of the JV Transaction, obtaining the minor permits required for Copper World Phase I, no significant unanticipated challenges, litigation or delays to the advancement of Copper World, maintaining the Company’s 3-P plan for sanctioning Copper World, including the DFS meeting the targeted IRR, no change in legislation or regulations and no other political or economic developments that would impact the Company’s ability to advance Copper World.

The risks, uncertainties, contingencies and other factors that may cause actual results to differ materially from those expressed or implied by the forward-looking information may include, but are not limited to, risks associated with satisfying the conditions to the closing of the JV Transaction, including the timing, receipt and any conditions associated with regulatory approvals, risks associated with reaching a definitive agreement with Wheaton in respect of the enhanced precious metals stream, risks generally associated with the mining industry, such as fluctuations in general macroeconomic conditions (including future commodity prices, currency fluctuations, energy prices and general cost escalation), litigation, regulatory and landholding risks associated with the development and operation of Copper World, changes in national and local governments, legislation, taxation, controls, regulations and other political or economic developments, the results of the feasibility study for Copper World, as well as the risks discussed under the heading “Risk Factors” in Hudbay’s most recent annual information form, a copy of which has been filed under Hudbay’s profile on SEDAR+ at www.sedarplus.ca and the company’s Form 40-F, a copy of which has been filed under Hudbay’s profile on EDGAR at www.sec.gov.

Should one or more risk, uncertainty, contingency or other factor materialize or should any factor or assumption prove incorrect, actual results could vary materially from those expressed or implied in the forward-looking information. Accordingly, you should not place undue reliance on forward-looking information. Hudbay does not assume any obligation to update or revise any forward-looking information after the date of this news release or to explain any material difference between subsequent actual events and any forward-looking information, except as required by applicable law.

About Hudbay

Hudbay (TSX, NYSE: HBM) is a copper-focused critical minerals mining company with three long-life operations and a world-class pipeline of copper growth projects in tier-one mining jurisdictions of Canada, Peru and the United States.

Hudbay’s operating portfolio includes the Constancia mine in Cusco (Peru), the Snow Lake operations in Manitoba (Canada) and the Copper Mountain mine in British Columbia (Canada). Copper is the primary metal produced by the Company, which is complemented by meaningful gold production and by-product zinc, silver and molybdenum. Hudbay’s growth pipeline includes the Copper World project in Arizona (United States), the Mason project in Nevada (United States), the Llaguen project in La Libertad (Peru) and several expansion and exploration opportunities near its existing operations.

The value Hudbay creates and the impact it has is embodied in its purpose statement: “We care about our people, our communities and our planet. Hudbay provides the metals the world needs. We work sustainably, transform lives and create better futures for communities.” Hudbay’s mission is to create sustainable value and strong returns by leveraging its core strengths in community relations, focused exploration, mine development and efficient operations.

For further information, please contact:

Candace Brûlé

Vice President, Investor Relations, Financial Analysis and External Communications

(416) 814-4387

investor.relations@hudbay.com

Figure 1: Significant Reduction in Hudbay’s Capital Contributions Results in 90% Levered IRR

The JV Transaction and the Wheaton Stream will provide Hudbay with significant financial flexibility to fund the development of Copper World with approximately $200 million in expected remaining capital contributions from Hudbay based on PFS estimates and the first contribution not expected until 2028 at the earliest. Based on the anticipated funding structure for Copper World, the expected project IRR to Hudbay, on a levered basis, increases to approximately 90%ii.

i Based on the PFS published on September 8, 2023, which included an estimated initial direct capital investment for Phase I of Copper World of approximately $1.5 billion before the impact of equipment financing. The PFS also contemplates an additional $0.4 billion investment in year four for the construction of a concentrate leach facility.

ii Based on the initial capital investment and the $3.75 per pound copper price used in the PFS published on September 8, 2023 with assumptions of approximately $145 million for pre-sanctioning costs, $230 million from the precious metals stream, $350 million from project-level financing and approximately $700 million from the joint venture partner initial payment, matching contribution and capital contributions.

iii Average analyst consensus net asset value estimate for 100% of Copper World is approximately $1.16 billion as of August 12, 2025.

iv Net debt to adjusted EBITDA, cash costs and sustaining cash costs are non-IFRS financial performance measures with no standardized definition under IFRS. For further details on why Hudbay believes cash costs are a useful performance indicator, please refer to the company's most recent management's discussion and analysis for each reporting period.

v Expected U.S. taxes paid over the initial 20-year mine life based on the Copper World PFS dated on September 8, 2023 using a copper price of $3.75 per pound.

vi Sourced from S&P Global. Based on a peer set comprised of greenfield, open pit, copper porphyry projects with reserves located in the Americas, with life of mine average copper production of + 60ktpa.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/ea7fca09-079a-45ef-9776-5d581d49e3c6