The nuclear energy stocks industry has marched back into relevance, propelled by the power-hungry reality of modern computing and data infrastructure. As electricity demand climbs around the clock, nuclear power is distinguishing itself through reliability, scale, and low-carbon credentials, neatly aligning commercial necessity with long-term sustainability priorities.

Nuclear equities substantially rewarded investors last year as governments extended reactor lifespans, approved new projects, and reinforced policy support. Cameco Corporation (CCJ), a leading uranium miner and fuel-services provider, emerged as a clear beneficiary, solidifying its position as a cornerstone name within the sector.

Furthermore, a recent congressional disclosure briefly drew attention but altered nothing fundamental. Representative Gilbert Ray Cisneros Jr. reported selling between $1,001 and $15,000 of Cameco shares on Dec. 24, 2025, disclosed Jan. 12, through a trust account, an administrative note rather than a market signal.

However, the outlook for the uranium market, which continues to strengthen, is more significant. Rising nuclear power demand and new reactor builds are tightening uranium supply, setting the stage for a sharp price rally this year.

On that note, let us explore whether this setup calls for following the exit or leaning into the opportunity by picking up Cameco shares.

About Cameco Stock

Based in Saskatoon, Canada, Cameco commands a market cap of roughly $50.7 billion. The company supplies uranium fuel globally, operating mining, refining, and fuel-service assets while maintaining strategic investments tied to nuclear technology, energy security, and regulated power markets.

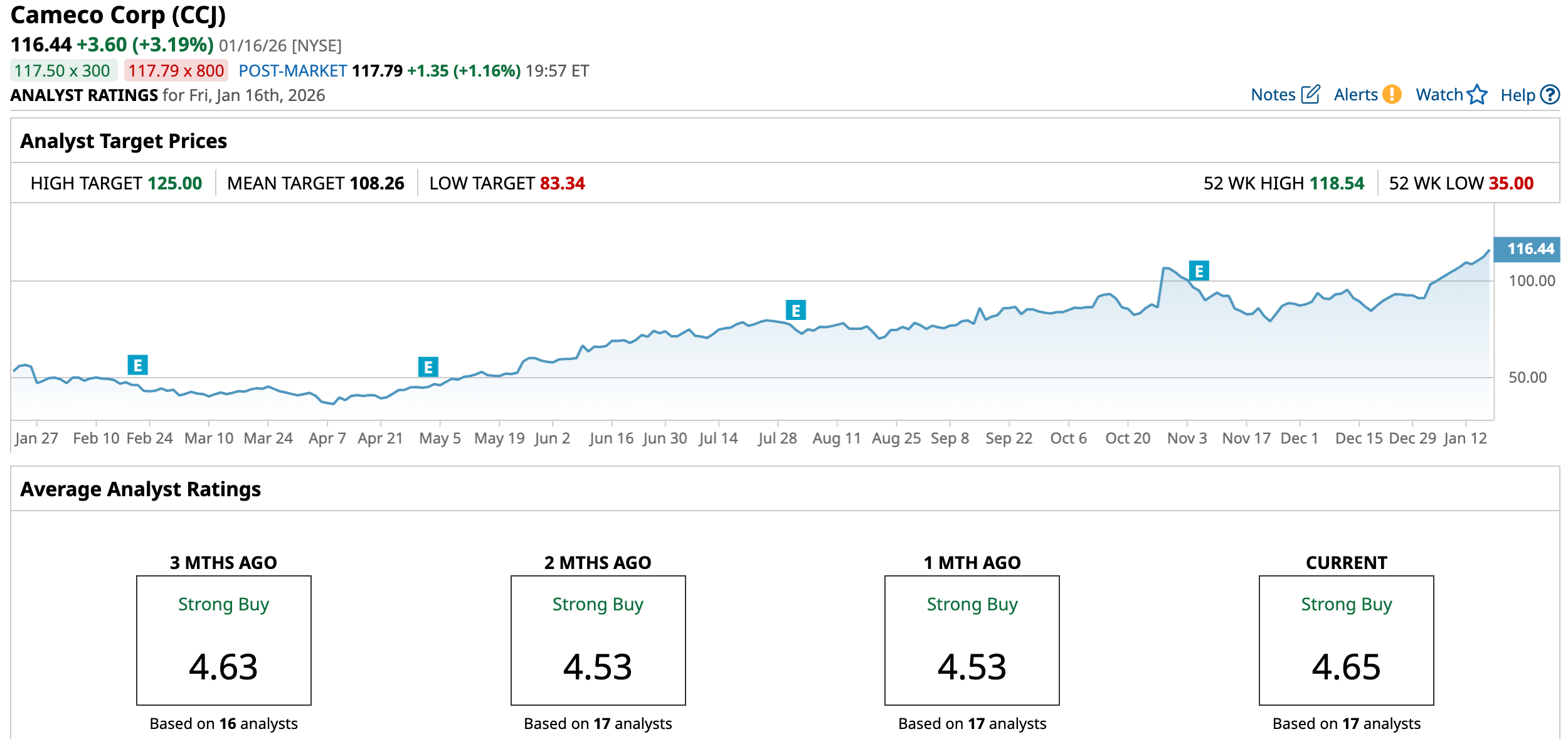

Market performance reflects the positioning. Cameco shares have surged 135.18% over the past 52 weeks, gained 52.83% over six months, and jumped another 33.76% in the last month. In addition, the stock has left its peer group behind as the Sprott Uranium Miners ETF (URNM) gained 69.23% over the past year, 43.27% over six months, and 28% in one month.

Valuation, however, demands respect. CCJ stock is currently trading at 111.55 times forward adjusted earnings and 20.54 times sales, levels that exceed both industry averages and their own five-year average multiples. The premium reflects confidence in long-term growth.

For those seeking stability, Cameco remains the sector's blue-chip anchor. The company pays an annual dividend of $0.17 per share, yielding 0.16%. Its most recent dividend of CAD $0.24 ($0.17) was paid on Dec. 16, 2025, to shareholders of record on Dec. 1, 2025.

Cameco Misses on Q3 Earnings

On Nov. 5, 2025, Cameco reported third-quarter fiscal 2025 results that missed expectations on both fronts. Revenue declined 14.7% year-over-year (YOY) to CAD $615 million ($442.5 million), falling short of analyst estimates, while adjusted EPS landed at CAD $0.07, well below the Street forecast but improved 16.7% from the prior year’s quarter.

However, the headline miss masked a steadier operational foundation. Cameco closed the quarter with CAD $779 million ($560.5 million) in cash and cash equivalents, reinforcing balance sheet resilience at a moment when uranium market conditions are tightening.

The quarter’s most consequential development came strategically. Cameco announced a landmark partnership with Brookfield Asset Management (BAM) and the U.S. government to accelerate Westinghouse reactor deployment. The collaboration carries an aggregate investment value of at least $80 billion, materially expanding Cameco’s long-term growth runway.

Operational visibility remains equally compelling. Cameco holds contracts covering more than 28 million pounds of uranium for average annual delivery over the next five years, anchoring future revenues while preserving leverage to higher pricing environments.

Looking ahead, earnings momentum appears set to reaccelerate. Analysts expect current-quarter fiscal 2025 EPS to rise 11.54% YOY to $0.29. Full-year EPS is projected to jump 100% to $0.98, followed by another 54% increase to $1.51 in fiscal 2026.

What Do Analysts Expect for Cameco Stock?

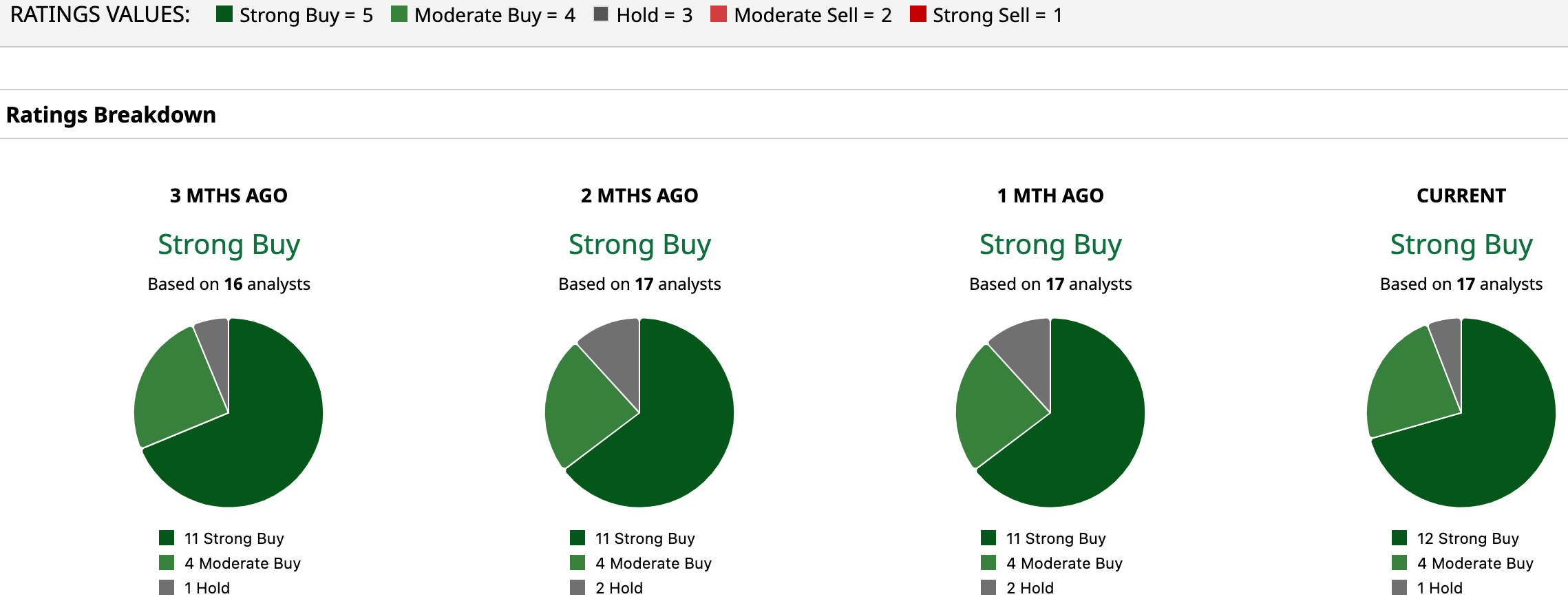

Wall Street remains firmly in Cameco’s corner. Its stock carries a “Strong Buy” consensus rating, with 11 analysts rating it a “Strong Buy,” four suggesting a “Moderate Buy,” and only two recommending a “Hold.”

Much of that optimism already sits in the share price. CCJ stock is already trading above its mean price target of $108.26. Meanwhile, the Street-high target of $125 implies potential upside of 7.35% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart